Unique US positioning and strong audience approval

ONE’s brand tracker study with GWI helped them both validate their hunches and uncover some surprising truths. These insights proved they were perfectly placed to work with brand partners looking to connect with a unique and passionate audience in a compelling way.

Here’s what the data showed:

- Overall martial arts viewership is growing in the US, but crucially, ONE’s share of that viewership is growing, and their fans are much more engaged and discerning.

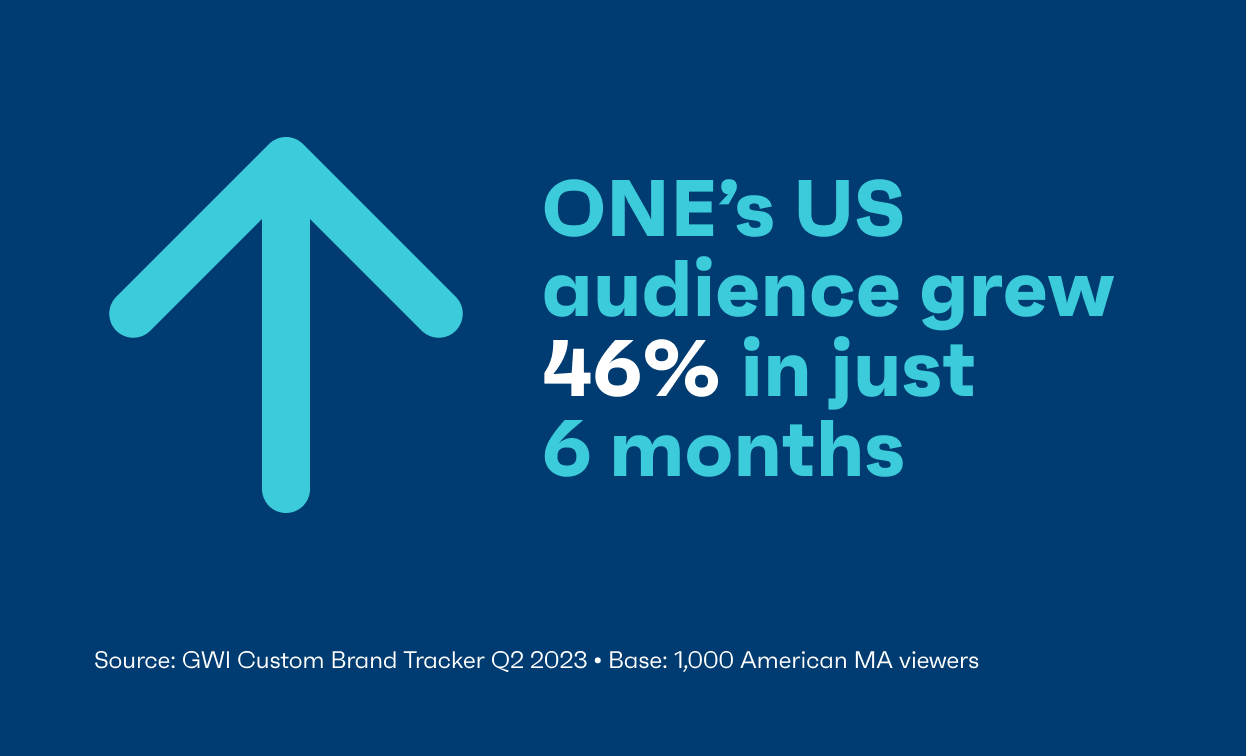

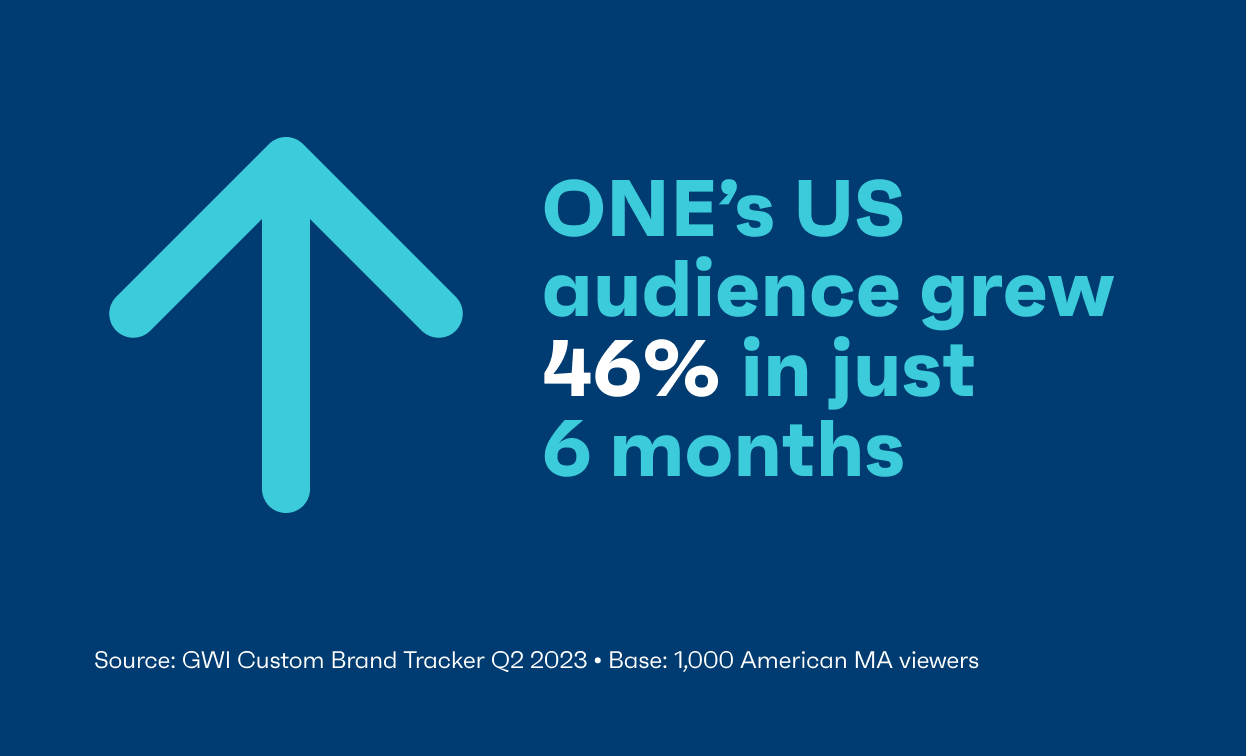

- ONE’s US audience grew 46% over a six-month period (between December 2022 and May 2023).

- On average, ONE viewers spend more time watching martial arts compared to non-ONE viewers (4.9 hours versus 2.7 hours weekly).

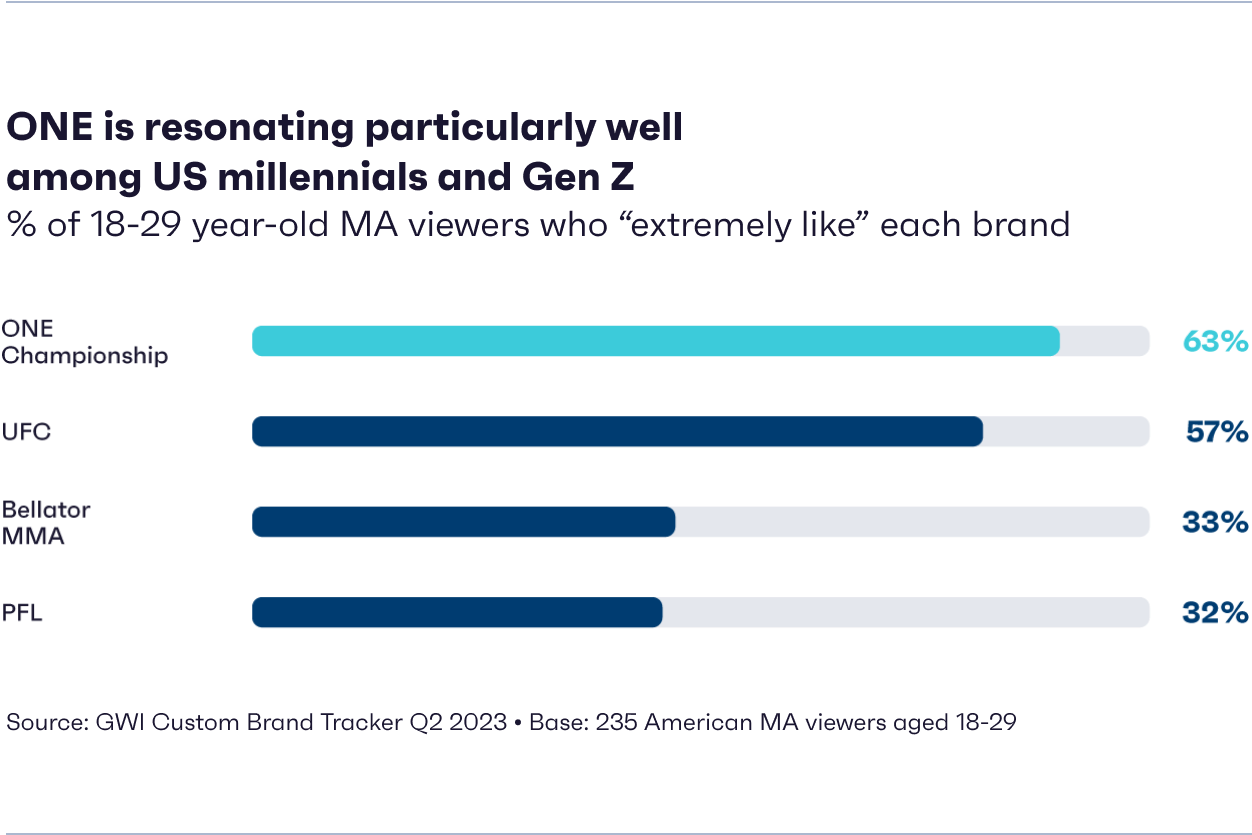

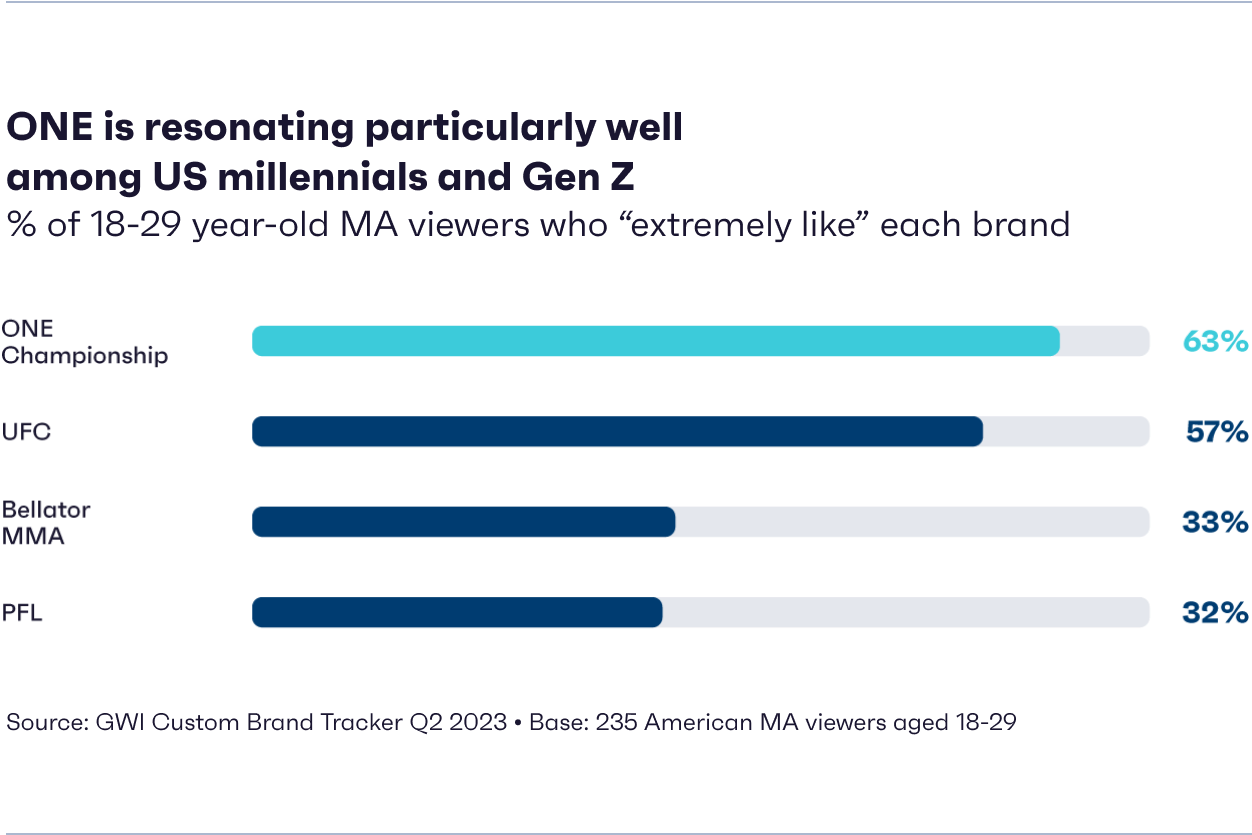

- 63% of 18-29 year-old viewers say they “extremely like” ONE, making them the most-liked martial arts/MMA organization among younger demographics.

- 45% believe ONE “prioritizes athlete health and safety” compared to just 35% for the UFC.

- 48% find “inspiration” from ONE. Younger sports audiences expect more than just a great match; they demand a responsible, forward-thinking organization that gives value back to the world.

- ONE viewers discuss on online forums (+30%) and bet on martial arts matches (+22%), vs. non-viewers – another indication that ONE is resonating with younger audiences who consume sports differently to older audiences.

“Our content naturally resonates super well with millennials and Gen Zs – the data showed our brand affinity was actually the highest compared to our peers, which was very reassuring to see.”

With ONE’s very human mission squarely focused on inspiring people and championing martial arts values – a key differentiator versus other combat sports organizations – the study also validated their assumptions that fans truly saw them as such, and understood what they were all about.

“This study proves our fans really understand what our brand represents: it's about respect, sportsmanship, diversity... people get it. These insights help our teams continuously think about ways to hone ONE’s brand proposition in our content production.”

Here’s what ONE did with these insights:

Equipped with this knowledge, along with the ability to dive deeper into the GWI platform for a more detailed look, the ONE team could make a clear and compelling case for partnering with them – and they knew exactly who that ideal partner was: Amazon.

Visionaries who were passionate about taking the sports viewing experience to new heights, Prime Video perfectly aligned with ONE’s ambition.

Approaching Prime Video with intel that proved ONE fans were far more engaged than most, they successfully won the partnership. The two have now set out to optimize the live event viewing experience on Prime Video together.

“Amazon is probably one of the most data-driven companies in the world. So this data, and our insights team, have played a crucial role in this partnership from the very beginning.”

Hosting a sold-out US debut event in May, ONE was able to elevate Muay Thai to a global stage.

“Our first on-ground event in Denver was a smashing success – what surprised me a little was that around 50% of fans traveled from out of town to attend our event. They’re also so knowledgeable about our athletes and the various disciplines we host. They just understand the brand so well. That gave us a big boost of confidence that we not only have the right to play in the US, we also have a great opportunity to win that market as well.”

Their unique positioning in the American market undoubtedly led to ONE’s US audience growing 46% over a six-month period.

“The US is definitely going to be one of our key markets in the next few years. We’re going to continue tracking, measuring, and listening to our fans – to the combat sports community on the ground – really shaping our product around their needs and giving them a very differentiated, refreshing viewing experience.”

Continuing their efforts, with a real sense of pride around how they’ve grown to harness the power of data, Jane and the ONE team have no intention of slowing down.

“Data and insights are at the core of our strategy. It’s definitely a differentiator for us compared to other sports organizations; our creatives are world-class and very good at what they do. When the art meets the science – that’s when magic happens.”

.png)