Let’s talk shop

Use the arrows below to jump to the sections you want to check out

How people buy

Purchase journeys

Where people buy

Online vs. in-store

Spotlight

US shoppers

Why people buy

The psychology

of shopping

Spotlight

APAC luxury

Key takeaways

Our insights help retail brands win

Show me how

Use the arrows below to jump to the sections you want to check out

It’s been a whirlwind few years for retailers, and today there are more ways to shop than ever before. Not to mention, the cost of living crisis has hugely impacted consumers’ spending habits and expectations.

Brand loyalty is strained, with competition for customers fiercer than an air fryer sale at Macy’s. If you can’t keep up with what people want, you’ll find yourself at the back of the queue.

But with the latest retail insights to guide you, you’ll know exactly where and how to invest to drive revenue and repeat purchases faster.

Andrew Mirzai, senior digital strategist at Connective3

“The pandemic forced more advertisers online, raising the bar for good brand experiences. Consumers now demand seamless UX, fast shipping, reviews, and deals. Without them, you must offer a distinct advantage, like a unique product or brand tone; otherwise, you'll compete in a losing race, with giants like Amazon leading.”

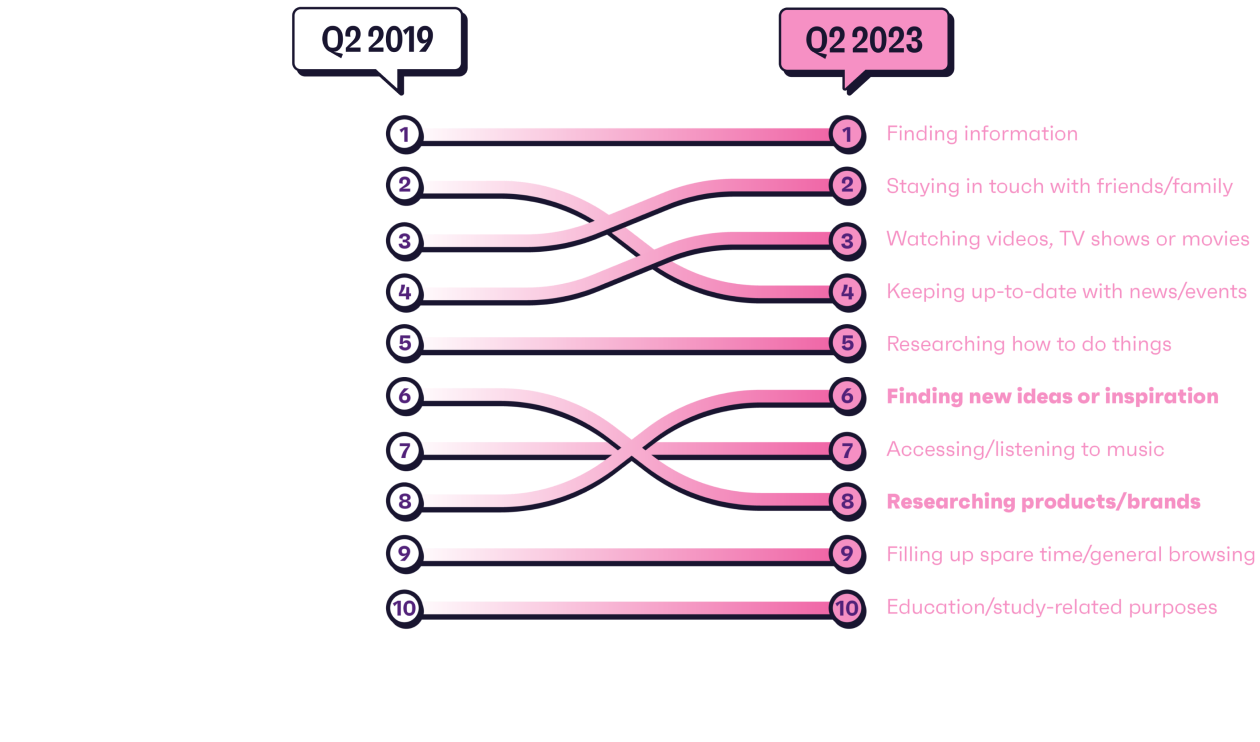

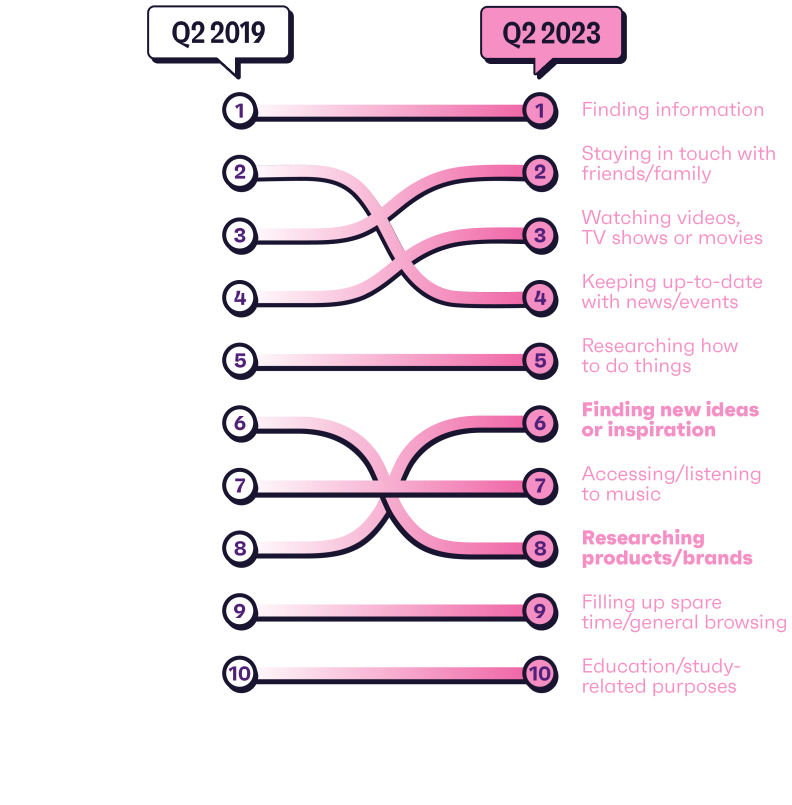

The way we search for products and brands is changing. Rather than looking for specific products online, discovery is happening more naturally – and social media is a huge driver.

Our data shows this change is driven by younger consumers seeking inspiration – but interestingly, older groups are starting to follow suit.

Rank based on the % who say the following are important reasons for using the internet

Social media is becoming just as important for brand discovery and research as search engines, and it’s unlikely this trend will reverse.

Many of us have fallen victim to TikTok Shop’s ease – an example of inspiration-led shopping done right. And it’s only getting bigger: TikTok are testing “Trendy Beat”, a new in-app shopping section for products shipped and sold by a subsidiary of its parent company, ByteDance.

Brands need to stay ahead of what’s culturally relevant to their audience, using these insights to create timely inspirational content and drive more engaging social commerce campaigns.

Once you understand how buyers shop, you can anticipate their decisions and tailor your strategy to meet their needs. Creating more personalized, seamless paths to purchase eliminates barriers and builds consumer confidence in your brand. Fewer abandoned carts, more ROI.

Dragomir Rashev, activation director (EMEA & APAC) at Proximo Spirits

“In the contemporary world where the mysteries of marketing have long been revealed, brands need to get on the side of consumers and co-create products and experiences with them, rather than sell to them and force their own agenda.”

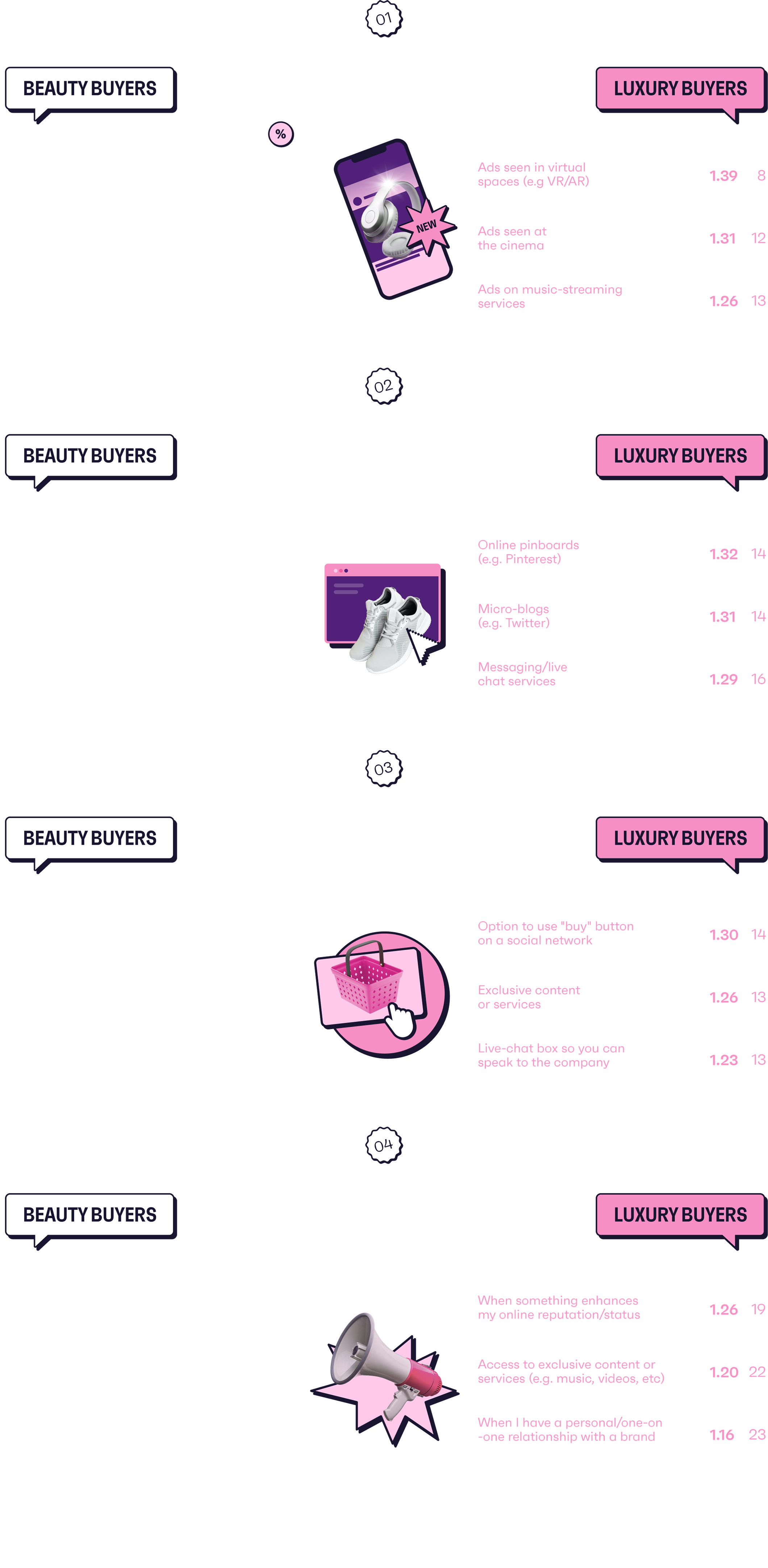

But remember – no two audiences are the same. As an example, let’s compare the online purchase journeys of beauty buyers and luxury buyers.

Time is money – from fuss-free express checkout to fast queries and answers via live chat, offer clear information upfront. Include a “buy” button on social ads to entice luxury buyers.

Online pinboards help both groups find more info, indicating they respond well to visual touchpoints when shopping online. To attract luxury buyers, invest in immersive, tech-driven experiences.

Access to exclusive content/services boosts brand advocacy, so go the extra mile to make customers feel special (e.g. free shipping, early sale access, invites to new store openings).

Celeb endorsements and vlogs help beauty buyers discover and learn about products, so work with influencers who align with your brand to drive authenticity, trust, and ultimately – sales.

Nearly a quarter of beauty buyers say having a one-on-one relationship with a brand would motivate them to be an advocate, so personalize online shopping experiences to win their loyalty.

Jenna Landi, director of global brand research at Pinterest

“If the first 20 years of ecommerce solved instant buying, the next 20 will solve the joy of shopping. Pinterest sits at the intersection of discovery and commerce and is uniquely positioned to recapture the joy of shopping online.”

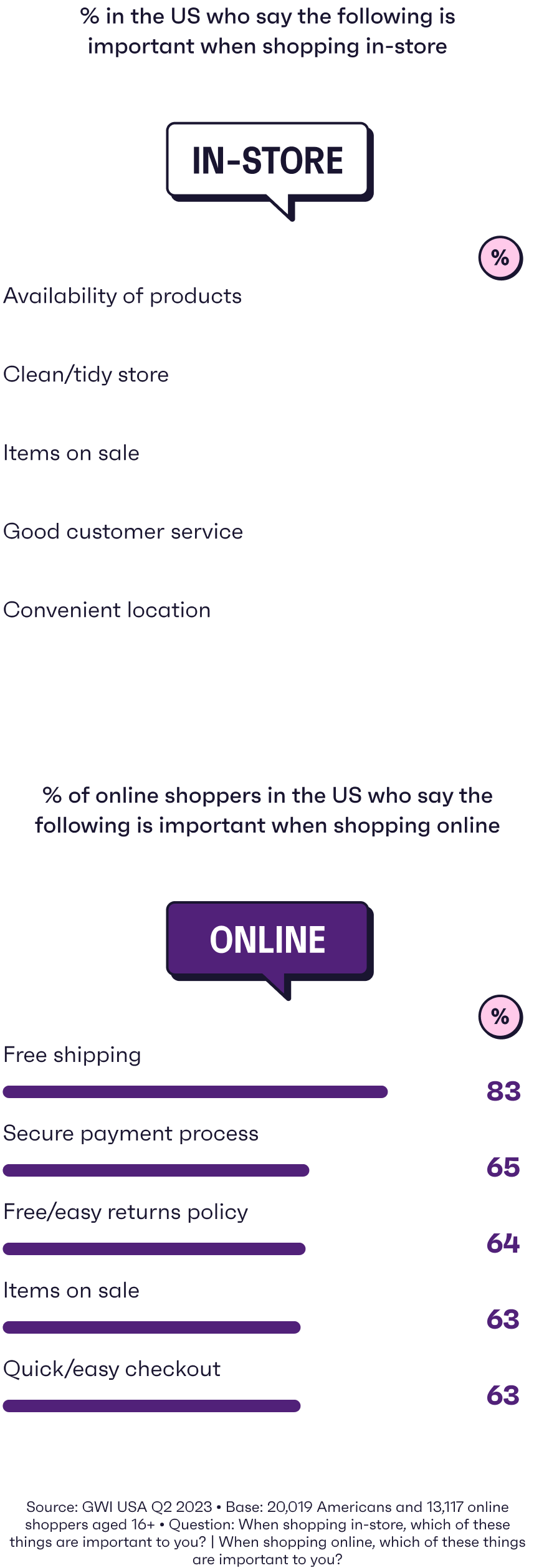

Consumers want the best of both worlds. When they shop in-store, they want an experience that’s just as quick and seamless as shopping online.

Convenience matters just as much as great customer service. Brands should aim to deliver a smooth, consistent omnichannel shopping experience, however and wherever people choose to shop.

Activewear brand Sweaty Betty is leading by example, using NewStore’s mobile omnichannel platform across its 73 stores in the UK and Ireland to provide a seamless, scalable omnichannel experience for customers and store colleagues. The goal is to minimize wait times, streamline refunds, and provide a more personalized customer experience.

Sarah Bull, head of consumer (EMEA) at Deckers Brands

“We recognize that our consumers desire and value personalized and one-to-one experiences over a generic, one-size-fits-all approach.”

It’s easy to get caught up in all the exciting new tech innovating commerce right now, but don’t overlook the basics that got you here in the first place. They still have a big part to play in omnichannel retail.

Looking at how American consumers shop, here are the key factors influencing their buying journeys right now.

Younger generations stand out for wanting tailored recommendations when shopping online, so use personalized marketing strategies to offer them relevant products/ promotions.

Baby boomers want reassurance when shopping online, so provide secure payment gateways and transparent return policies to build their confidence and trust.

Prioritize speedy delivery – baby boomers stand out for wanting better shipping options, with same-day delivery (+39%) and next-day delivery (+10%) growing in importance since mid-2021.

Claire Daniels, CEO at Trio Media

“Ecommerce has changed beyond recognition; now being the primary, rather than secondary, choice for shoppers. It has had to adapt and become more immersive and more available, with most consumers choosing retailers based on speedy checkout experiences and the price of delivery.”

Gen Z and millennials want to see product demos, but also want limited interaction with store staff. Offer immersive experiences they can try on their own, with staff ready to help on request.

Gen X stand out for wanting loyalty points and not having to wait in line, so reward them for choosing you and keep footfall moving.

Older generations crave a streamlined experience with short queues and a convenient location, so provide clear signage and a clean, organized store layout.

Loyalty points are a growing US purchase driver (+11% in-store and +9% online since Q2 2021). Brands should prioritize loyalty programs that help customers’ money stretch further to keep them coming back.

New technology has the power to streamline both online and in-store shopping experiences. And interestingly, clothing and luxury buyers in particular may be more receptive to it:

Clothing

buyers are

19%

more likely than the average consumer to follow the latest tech news/trends, and 10% more likely to think customer service chatbots are a useful and helpful tool

Luxury

buyers are

45%

more likely than the average consumer to say they buy new tech products as soon as they’re available

Clothing buyers

in the US are

24%

more likely than the average consumer to say they’ve shopped at the Apple store in the last 3 months

Did they see our data? The Hermès x Apple Watch collaboration features designer straps and a Lucky Horse mascot which taps into the label’s equestrian roots. Authentic, on brand, and very on trend.

Online retailers are already embracing generative AI to create 3D apparel images and ChatGPT plugins to help with queries. During peak periods (e.g. Black Friday), AI-powered recommendations and time-sensitive messaging are helping to boost conversion and faster checkout.

Meanwhile in stores, fashion retailer Zara has introduced AI robots to pick products from stock rooms in efforts to reduce queues and speed up collection. Using innovative tech to deliver fast, convenient experiences like this will help brands lure shoppers back to stores.

Chris Adams, consultant and founder of Hey Honey

“Technology changes retail, culture steers success. Brands’ true engagement challenge isn’t mere innovation adoption; it’s grasping behavior, aligning with the brand, and wisely applying ecommerce advancements while understanding culture’s impact.”

From impulse buying to planned purchases, retailers need to get up close and personal with their audiences to understand the why behind the buy.

Consumers have a lot going on right now, and their behavior isn’t always rational. With the cost of living crisis in full swing, emotional spending is on the rise – especially among millennials who stand out for saying they impulse buy to cope with stress.

People are buying mood-boosting treat purchases to feel better about the whole situation. Perhaps they can’t afford to buy a house right now, but they can afford those super cute shoes with 50% off…

Younger consumers are more optimistic about their finances, which may explain why they’re more likely to impulse buy. Two-thirds of Gen Z say they live at home with their parents, so they’re saving money on rent and may have more disposable income to play with.

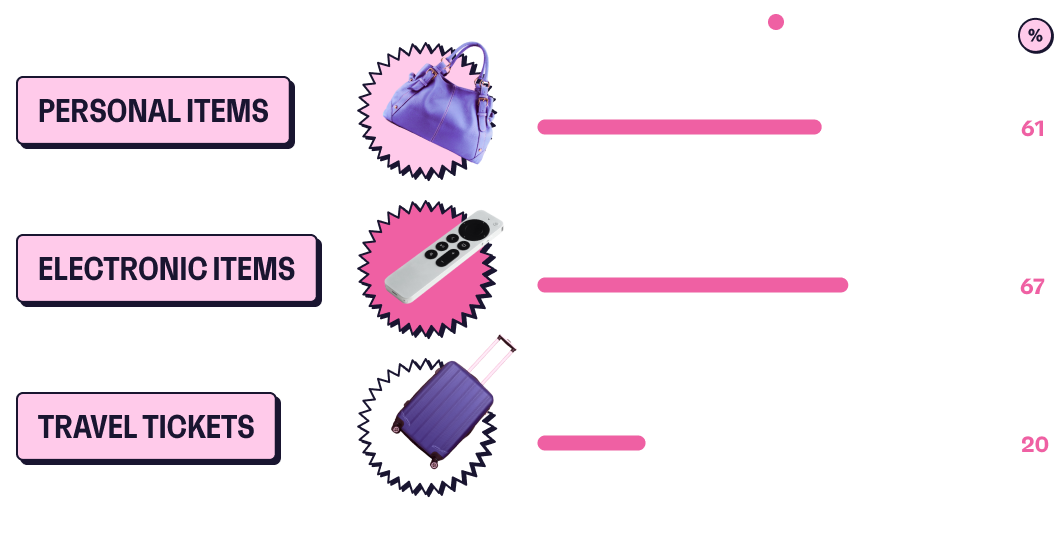

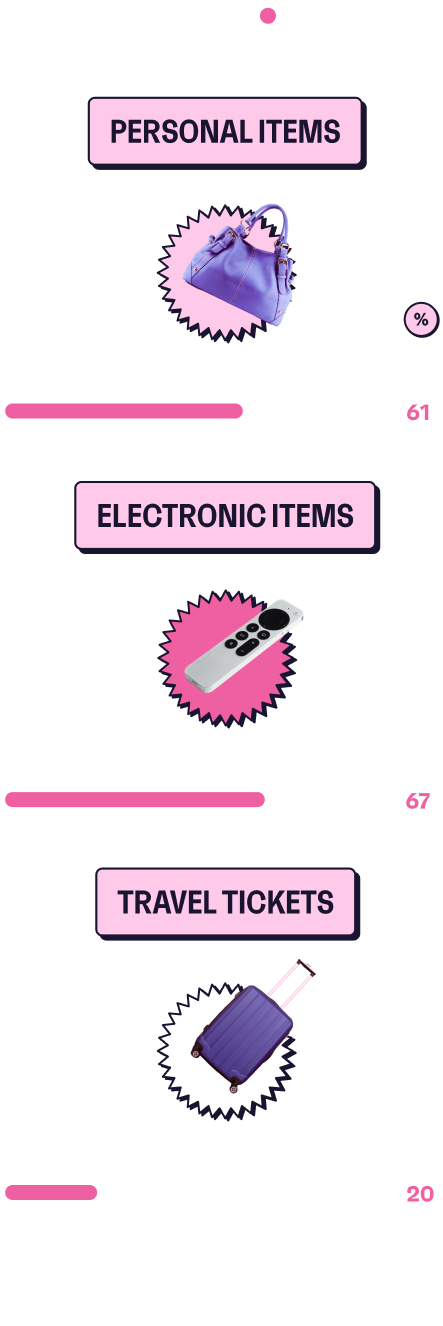

% who planned to buy the following products in the next 3-6 months vs. those who said they followed through

Pay attention to consumer intent – more people end up buying products on a whim than intended, suggesting there's more demand than brands might realize.

Brand building now with effective ad campaigns will help retailers tap into demand later, which will continue to grow as the economy settles down.

Older generations don’t want to feel like they’re missing out on a great deal, so work this into your messaging when targeting them.

Younger generations’ standout reasons to impulse buy are tied to social media, so partner with authentic creators to drum up brand awareness and inspire their next purchase.

Mahmoud Shammout, head of research & insights (METAP) at TikTok for business

“62% of online shoppers make an impulse purchase at least once a month, rising to 70% among TikTok users.”

Consumers most want brands to be reliable (56%) – they want to know they can trust what they’re buying as we shift into a new, uncertain era of AI. Transparency and authenticity are key to building brand trust, which is also reflected in the companies, influencers, and creators you partner with.

The Barbie movie’s “pink movement” is proof next-level brand partnerships often exist where you least expect them. But for those on a non-Hollywood budget, how do you know which partners and products are worth the investment, and – crucially – will also feel like an authentic brand match?

Use audience insights to stay close to what else your consumers love, hate, and are buying. Their purchases may hint at what they’re planning next, so dig deeper into this data to find the right answers.

40% of consumers who bought a car in the last 6 months also said they bought a domestic vacation. Coincidence? Maybe. Or perhaps it’s an opportunity for car brands and travel providers to team up, tailor their messaging, and tell an authentic, engaging story that taps into their audience’s mindset and drives sales. We’ll just leave this here…

Consumers in Asia-Pacific can’t get enough of luxury – they love dupes just as much as the real deal. And they aren’t waiting for sales either:

Consumers in APAC are

13%

more likely than the average consumer to buy a product now at full price – the most likely of all world regions

16%

more likely than the average consumer to say they’ve regularly bought a luxury product in the last year

14%

more likely than the average consumer to say they’ve regularly bought fake/duplicate products in the last year, proving how contrary consumer behavior is

We often think of luxury retail as being ostentatious, with logos and bling splashed everywhere. But in reality, that’s not the case. When the economy’s unstable, flashy pieces take more of a backseat.

That’s why the quiet luxury trend is everywhere right now. People are opting for a minimalist look, buying more investment pieces that last, and shopping consciously.

Regional differences matter – out of four countries in APAC, consumers in China are most likely to say they’ve bought a luxury product in the last few months (32%), while those in Japan are least likely (14%). Segmenting your target audiences is essential to avoid spending in the wrong places.

Quality is the top reason luxury buyers in APAC purchased a luxury product, so lean on this in your messaging. Emphasizing aspects like durability and timelessness will help luxury buyers feel they’re getting the best bang for their buck.

Quiet luxury also extends to homeware, wellness, and beauty, with luxury buyers in South East Asia being 10% more likely than the average consumer to say they use facial skincare products weekly. Offer more in these categories for better ROI.

Fendi’s designer coffee carrier might seem bizarre, but they’re right on the money. Luxury clothing buyers stand out for visiting coffee shops monthly – in the UK they’re 27% more likely than the average consumer to say they’ve visited Caffè Nero and 18% more likely to have visited Costa Coffee.

No two buyers are the same. You need to look closely at consumer intent, trends in your industry, and the wider world beyond your brand for the full picture of who your audience is and what’s filling their shopping carts.

Driving revenue, growth, and loyalty starts with knowing:

HOW PEOPLE BUY

Inspiration is the starting point for consumers – by understanding how they discover and research brands/products, you can target them more effectively across the buying journey.

WHERE PEOPLE BUY

Omnichannel is the way forward – use new tech to personalize speedy, seamless shopping experiences both online and in-store, but don’t forget the basics like great customer service.

WHY PEOPLE BUY

Different audiences impulse buy for different reasons – understand buyers’ worlds beyond your brand to craft tailored, authentic messaging that resonates and drives sales.

Gemma Bend, marketing lead at 3manfactory

“To succeed in ecommerce in 2023, brands must take a holistic approach to the buyers' journey: integrate social commerce strategies, use AI-driven personalization, optimize mobile shopping experiences, and create content to engage and captivate their target customers.”

Turn browsers into buyers with the latest global retail trends. Our no-nonsense commerce report, You are what you buy, cuts straight to the carts of today’s shoppers. Let’s talk shop: