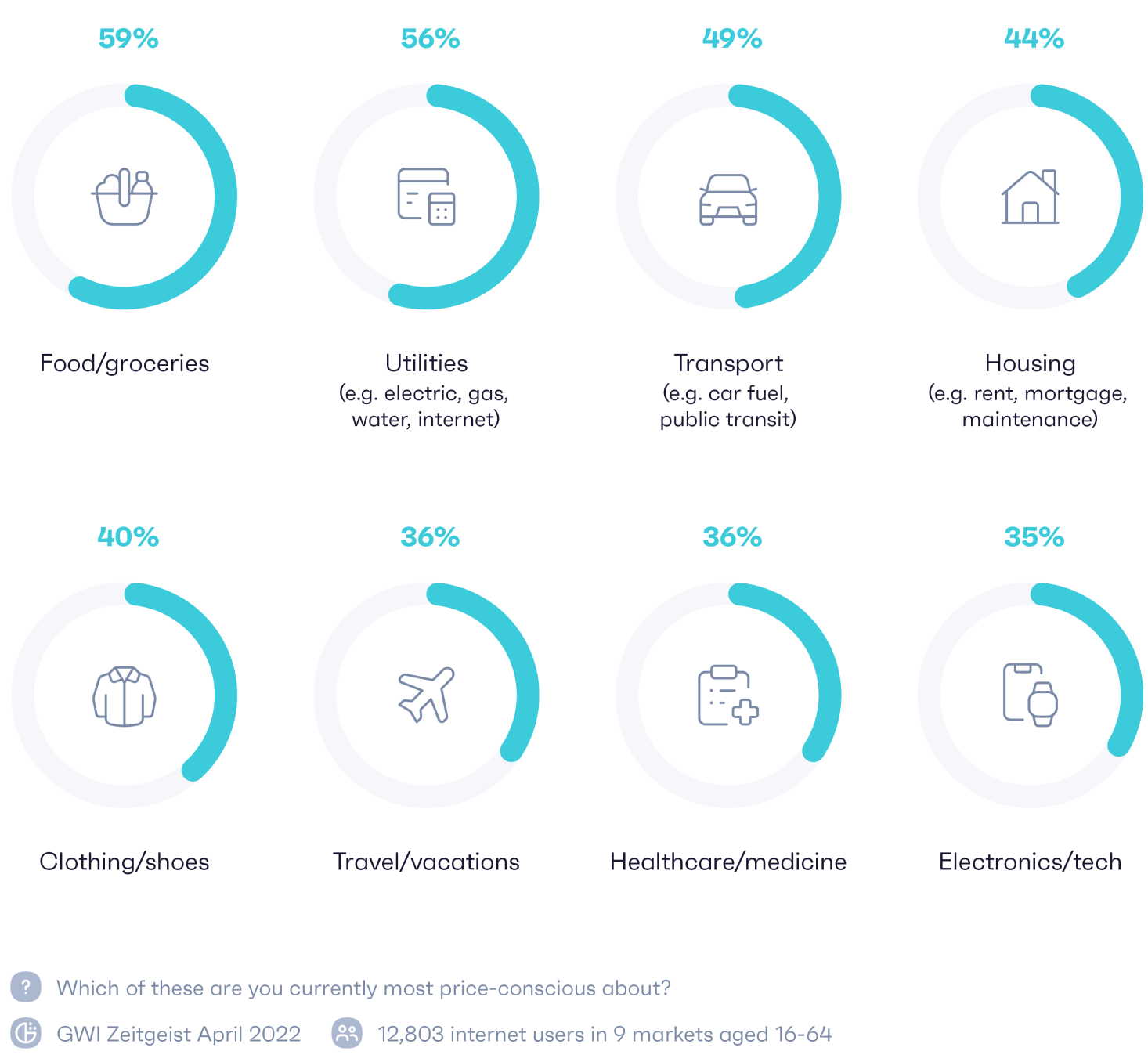

Fears about the future of national economies are up for the first time since Q2 2020, when we felt the initial impact of Covid lockdowns.

Personal finance concerns are also rising, with the biggest increases in Hong Kong, Israel, Japan, Sweden, and New Zealand. Of all markets tracked in our Zeitgeist data, UK consumers are the most likely (44%) to say they’re spending less compared to two years ago.

In the US, there’s a stark reverse trend to the carefree spending we saw back in November’s Connecting the dots report. Thriftiness is back in, while optimism, rebelliousness, and daringness are all down.

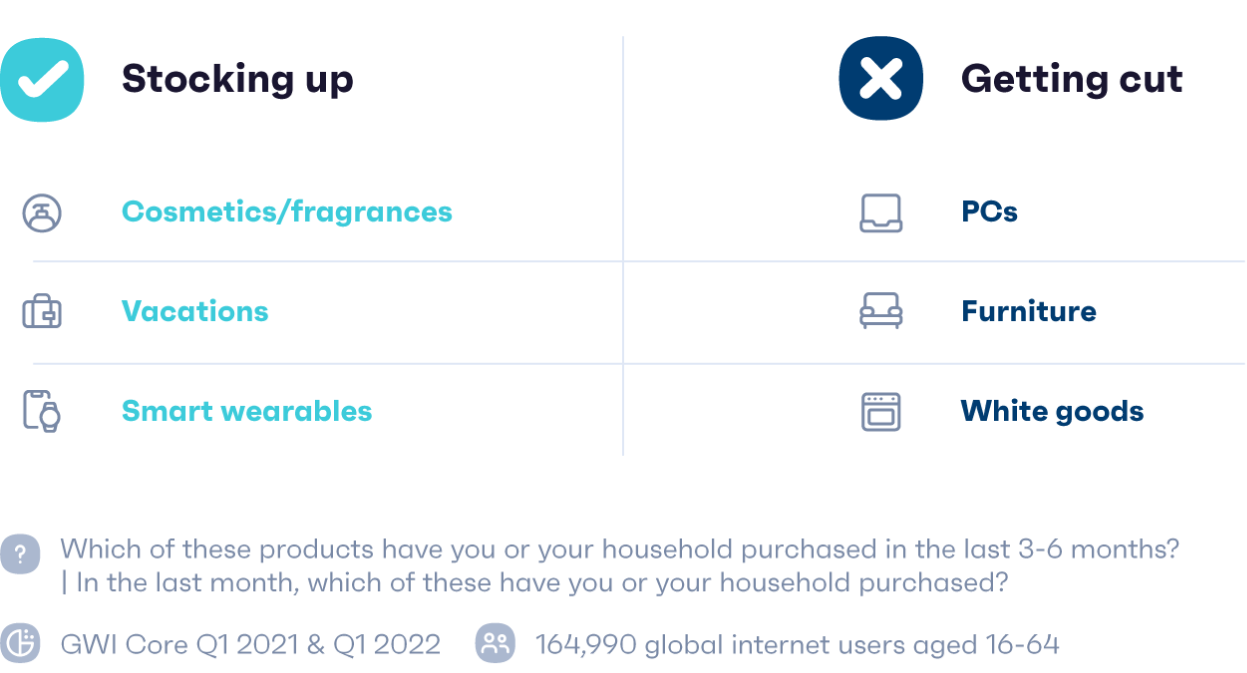

But not everyone is feeling the pinch. In fact, some consumers are unlikely to experience this financial dilemma at all, and may well spend more.